In the rapidly changing landscape of finance, online trading has emerged as a potent tool for individuals seeking to assert control over their investments and financial destinies. Thanks to technological advancements, financial markets have become more accessible than ever, enabling people to trade a diverse array of financial instruments from the comfort of their homes. The demat account opening process has become increasingly user-friendly, allowing investors to easily move on from traditional paper-based securities to electronic formats for a more efficient and streamlined investment experience. In this article, we will discuss five primary reasons why individuals are increasingly gravitating towards online trading to capitalise on its myriad advantages.

1. Enhanced Accessibility and Convenience

Online trading has experienced a surge in popularity due to its unparalleled accessibility and convenience. In contrast to traditional trading methods, which often necessitate a physical presence in a stock exchange or reliance on a broker, online trading empowers individuals to execute trades effortlessly with a few clicks. The elimination of geographical barriers allows people worldwide to participate in financial markets without being physically present.

Furthermore, online trading platforms operate around the clock, providing traders with the flexibility to engage in buying and selling activities at their convenience. This flexibility is particularly advantageous for those with hectic schedules or commitments during regular trading hours. The convenience of online trading has democratised access to financial markets, enabling individuals to make informed decisions and manage their portfolios autonomously.

2. Cost-Efficiency

Online trading has substantially reduced the costs associated with traditional trading methods. Historical engagement in financial markets often incurred substantial fees and commissions paid to brokers, contributing to the overall cost of trading. Online trading platforms have mitigated many of these intermediary costs, allowing traders to retain a more significant portion of their profits.

The presence of discount brokers and cost-effective trading platforms has further enhanced the cost-efficiency of online trading. These platforms typically offer competitive pricing structures, enabling traders to execute transactions at a fraction of the cost associated with traditional means.

3. Real-Time Market Information

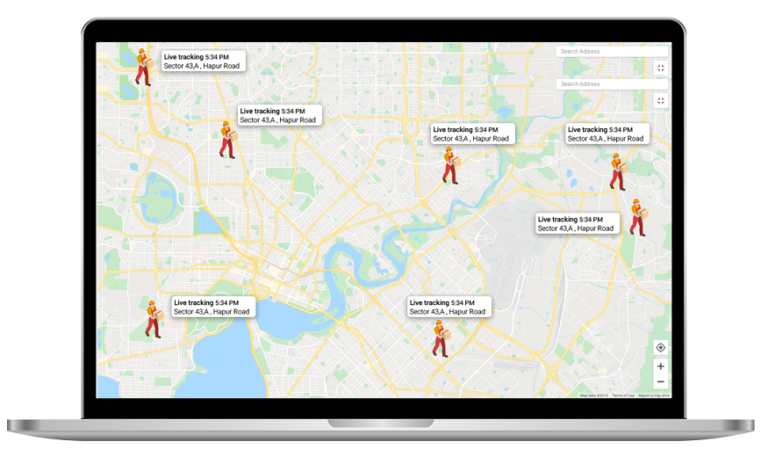

Future and options trading empowers investors with versatile strategies to navigate and capitalise on diverse market conditions. Timely access to market information is important for making informed trading decisions. Online trading platforms furnish users with real-time data, news, and analysis, empowering them with the information necessary to execute well-informed transactions. This instantaneous access to market trends, price movements, and global news facilitates quick reactions to changing market conditions and the ability to capitalise on emerging opportunities.

Moreover, online trading platforms often provide advanced charting tools and features for technical analysis, allowing traders to conduct in-depth analysis of stocks, currencies, and other financial instruments. The availability of real-time market information not only improves the decision-making process but also promotes a more proactive and responsive approach to trading. This real-time visibility stands as a crucial advantage of online trading compared to traditional methods, where information dissemination is often slower and less accessible.

4. Diversification and Global Markets

Online trading opens up opportunities for diversification, enabling investors to spread their risk across various asset classes and geographical regions. Traditional trading methods frequently confined individuals to local markets or specific asset classes, limiting their ability to construct a well-diversified portfolio. In contrast, online trading platforms provide access to a myriad of financial instruments, including stocks, bonds, commodities, and currencies, from markets around the world.

Diversification, a fundamental principle of risk management, is easily implemented through online trading. Traders can explore different sectors, industries, and regions, thereby reducing the impact of adverse events on their overall portfolio. The ability to trade in global markets also enables investors to seize opportunities that may arise in different parts of the world, contributing to a more dynamic and resilient investment strategy.

5. Control and Autonomy

Online trading empowers individuals by affording them greater control and autonomy over their investment decisions. Unlike traditional methods, where brokers often played a more active role in executing trades on behalf of clients, online trading allows users to take charge of their portfolios. Traders can define their investment goals, risk tolerance, and strategies and execute transactions accordingly.

The autonomy provided by online trading platforms extends to the ability to set stop-loss orders, limit orders, and employ other risk management tools. This level of control enables individuals to implement disciplined trading practices and mitigate potential losses. The transparency and immediacy of online trading mean that users can track the performance of their investments in real time, fostering a sense of accountability and awareness.

Conclusion

Online trading has emerged as a transformative force in the realm of finance, providing individuals with unprecedented access, cost-efficiency, real-time information, diversification opportunities, and control over their investments. As technology continues to advance, online trading is poised to become even more sophisticated, introducing new tools and capabilities to enhance the trading experience.

While the advantages are evident, it is important for individuals to approach online trading with a solid understanding of the markets, risk management principles, and a commitment to continuous learning. Armed with the right knowledge and strategy, online trading can serve as a powerful vehicle for unlocking financial potential and realising long-term financial goals.

In the rapidly evolving landscape of financial technology, a robust and user-friendly stock market app has become an indispensable tool for investors seeking to navigate the complexities of the market with ease and precision. Now you can experience the power of precision with Kotak securities trading platform, designed to elevate your financial journey.

+ There are no comments

Add yours